VCFO For MSME & Start Up

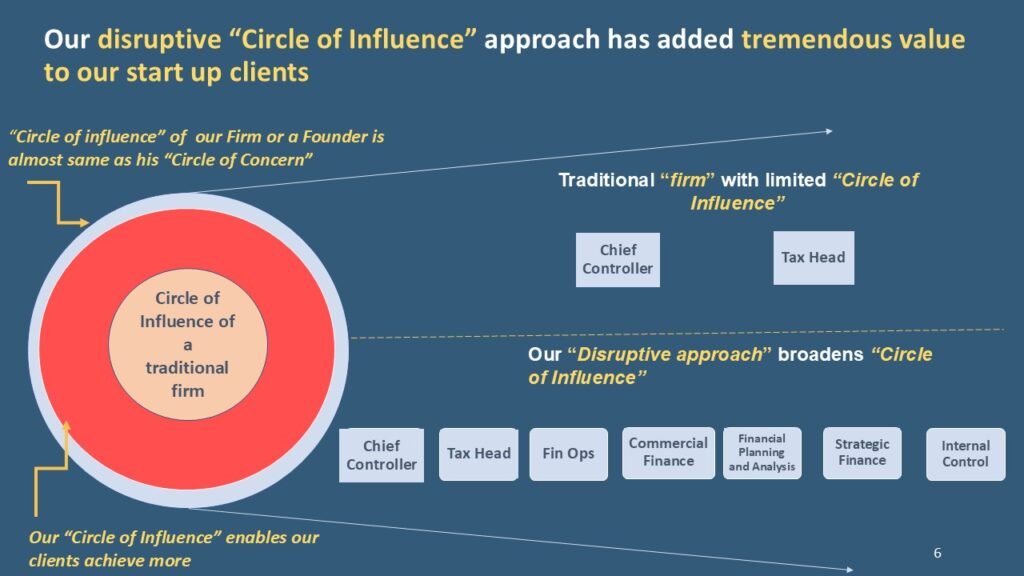

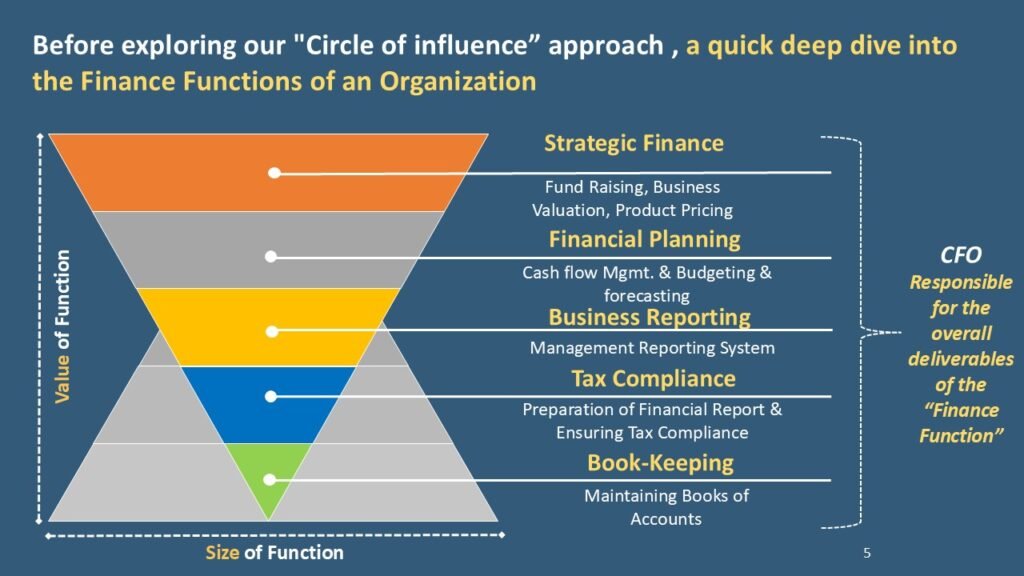

Companies are swiftly reorganizing their operations in response to digital advancements to tackle business challenges and capitalize on new growth prospects. Managing finances, audits, legal compliance, capital, internal regulations, and corporate governance necessitates expertise in the field. Neglecting any of these areas is not an option, thus making VCFO services indispensable.

For companies like Micro, Small & Medium Enterprises (MSMEs), startups, and small to medium-sized enterprises (SMEs), hiring a virtual CFO can be challenging due to resource constraints. As an alternative, businesses opt for outsourced VCFO providers to enhance performance and ensure smooth and cost-effective operations.

Hire a virtual CFO when:

1. Your business is experiencing growth and needs strategic financial management.

2. You require professional advice on regulatory compliance and business growth.

3. Tax and regulatory compliance are becoming more complex.

4. Detailed financial disclosures and industry comparisons are necessary.

5. You face budget pressures and need efficient reporting mechanisms.

6. Internal team coordination challenges arise.

7. You need an expert finance professional to manage finances and support decision-making.

8. Outsourcing financial management allows you to focus on business growth.

9. These services are particularly beneficial for start-ups and MSMEs: